In today’s digital age, writing a check may seem outdated to some, but it’s still a useful skill to have. Whether you’re paying rent, making a large purchase, or donating to a charity, knowing how to write a check correctly is important. In this comprehensive guide, like we always do in this blog, we will walk you through the step-by-step process of writing a check for $1,000. By the end, you’ll have the confidence to handle check transactions easily.

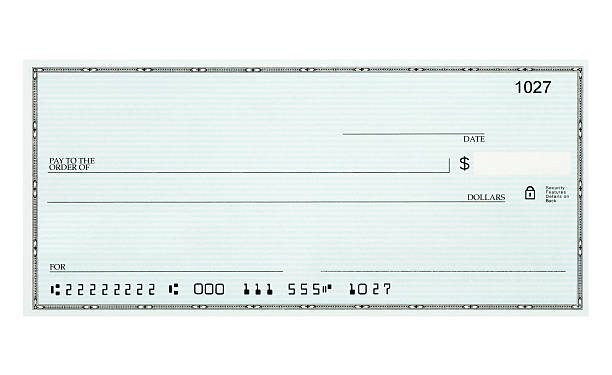

Understanding the Components of a Check

Before we delve into the specifics of writing a check, let’s familiarize ourselves with the various sections and terms found on a typical check. This knowledge will help ensure accuracy in filling out your check.

A check consists of several key components, including the following:

- Date Line: This is where you write the date the check is being issued. Be sure to use the correct date format.

- Payee Line: Write the name of the person or business to whom the check is payable. You can also use “Pay to the Order of” followed by the payee’s name.

- Dollar Box: In this section, write the numerical amount of the check, which in this case is “$1,000.”

- Amount Line: This is where you write out the amount in words. It’s crucial to be accurate and clear to avoid any misinterpretation.

- Signature Line: Sign your name here exactly as it appears on your bank account.

- Memo Line (Optional): You can include a memo on the memo line to provide additional information about the purpose of the payment.

Gathering the Necessary Information to Write a Check for 1000

Before writing a check for $1,000, it’s essential to ensure you have the necessary information readily available. This includes:

- Sufficient Funds: Make sure you have a balance of at least $1,000 in your account to cover the check amount.

- Recipient’s Name: Verify the correct spelling of the payee’s or business’s names.

- Check Amount: Confirm the amount you wish to write the check for, which in this case, is $1,000.

Step-by-Step Guide to Writing a Check for $1,000

Now that you’re familiar with the components of a check and have the necessary information let’s dive into the step-by-step process of writing a check for $1,000:

- Step 1: Date the check Start by writing the date on the designated line in the top-right corner of the check. Make sure to use the correct date format, such as “May 27, 2023.”

- Step 2: Write the recipient’s name or “Pay to the Order of” On the “Pay to the Order of” line, write the name of the person or business to whom you are giving the check. Ensure the name is spelled correctly and matches the intended recipient.

- Step 3: Write the numerical amount in the box. In the dollar box, write “1,000.00” to indicate the check amount numerically. Be sure to include the decimal point and double-check the accuracy of the amount.

- Step 4: Write the amount in words. Write the amount in words on the line below the recipient’s name. In this case, it would be “One thousand dollars and 00/100.” It’s crucial to be precise and legible to avoid any confusion.

- Step 5: Sign the check. Sign the check on the signature line using the same signature as your bank records. This signature verifies that you authorize the payment.

- Step 6: Memo line (optional) If you wish to include additional information about the purpose of the payment, you can write a brief memo on the memo line. For example, “Rent for May 2023” or “Charitable donation.”

Double-Checking and Reviewing the Check

After completing the check-writing process, take a moment to review the entire check for accuracy. Double-check the date, payee’s name, numerical amount, written amount, and signature. Also, verify that all the information is correct before submitting the check.

Tips and Best Practices

To ensure smooth check transactions and prevent any potential issues, consider the following tips and best practices:

- Consistent signature and handwriting: Develop a consistent signature and maintain a legible handwriting style to avoid confusion or potential challenges when processing the check.

- Writing clearly and legibly: Ensure all information is clear and easily readable when writing the check. Illegible writing can lead to delays or misinterpretations.

- Using proper security measures to prevent fraud: Protect your checks by storing them securely and immediately reporting any lost or stolen checks. Additionally, avoid pre-signing blank checks to prevent unauthorized use.

Ten platforms to write check for 1000

- QuickBooks Online: QuickBooks Online is a popular accounting software with a check-writing feature. It lets you create and print checks directly from the platform, streamlining your financial management.

- Zoho Books: Zoho Books is another comprehensive accounting software that enables you to write and print checks online. It provides customizable check templates and integration with your bank accounts for seamless transaction recording.

- Checkeeper: Checkeeper is a dedicated online check-writing platform. It allows you to create and print checks on blank stock or email digital checks. Checkeeper also offers features like check register management and check mailing services.

- PrintBoss: PrintBoss is a check-printing software that offers a secure and efficient solution for writing checks. It integrates with various accounting systems, allowing you to generate checks directly from your financial software.

- Deluxe eChecks: Deluxe eChecks is a digital check solution that eliminates the need for paper checks. It enables you to send secure and traceable electronic checks to recipients, providing convenience and reducing costs associated with printing and mailing.

- PayPal: PayPal is a widely recognized online payment platform that offers the option to send eChecks. You can link your bank account to PayPal and use their interface to write and send digital checks to recipients.

- Bill.com: Bill.com is a popular online bill payment and invoicing platform. It allows you to write and send checks electronically, streamlining your accounts payable process and providing an efficient way to manage payments.

- Square: Square, now Block, known for its payment processing services, offers the ability to create and send digital checks through its platform. This feature is handy for small businesses and freelancers.

- Online Banking: Many banks provide online banking services that allow you to write checks electronically. You can access check-writing features and manage your payments conveniently through your bank’s website or mobile app.

- Check Writing Software: Various standalone check-writing software options, such as CheckBuilderPro and CheckWriter, are available. These programs provide comprehensive check-writing capabilities, including customization, printing, and register management.

These platforms offer convenient alternatives to traditional check-writing methods, making it easier to manage your financial transactions. Choose the one that best suits your needs, ensuring it integrates with your accounting software or bank accounts for a seamless experience.

Frequently Asked Questions (FAQs)

What if I make a mistake while writing a check?

If you make a mistake while writing a check, it’s best to void it and start over with a new one. Avoid crossing out or using correction fluid, as it may raise suspicions of tampering.

Can I write a check for more than my current balance?

Writing a check for an amount greater than your current balance can result in overdraft fees or the check being returned unpaid. Always ensure you have sufficient funds in your account to cover the check amount.

Are there any legal requirements or restrictions?

While the process of writing a check for $1,000 follows general guidelines, it’s essential to be aware of any specific legal requirements or restrictions that may apply in your jurisdiction. Familiarize yourself with local regulations to ensure compliance.

Conclusion

Mastering the art of writing a check for $1,000 empowers you to handle various financial transactions confidently. Following this step-by-step guide will give you the knowledge and skills to complete check transactions accurately and efficiently. Remember to double-check your work, maintain legible handwriting, and practice proper security measures to ensure smooth check processing. So go ahead, grab your checkbook, and implement this guide. Happy check writing! Follow this blog to learn more about freelance writing.

Comments 1